A paradigm shift in payments is observed after Covid –19 and there was a surge in a cashless society which is an arm of digital transformation in facilitating e-commerce payments. As the next normal, we see these trends to be emerging and accelerating. As banks are rapidly partnering with technology companies to transform the future of payments, here’s how banks are innovating to drive efficiency by embedding payments and financial components.

Current Market Situation

The new and innovative payment systems are staying in the competitive ring in markets. Even banks can sense the scaling of payments as traditional payment customers are migrating towards cashless transactions.

Our analysis states that major digital players – Paypal & Square have accelerated their performance to a massive level more than the UK banks and payment processors – Visa & Mastercard achieved 2.6 times the TRS of UK banks since 2016.

However, the future of the payments landscape is unpredictable. It’s to determine whether traditional cards get replaced with account-to-account transactions and digital currencies, and possible new use cases will be unlocked for merchants. As we envision the innovations to happen by the global fintech unicorns, it’s also challenging for them as well to meet 100% cashless payments.

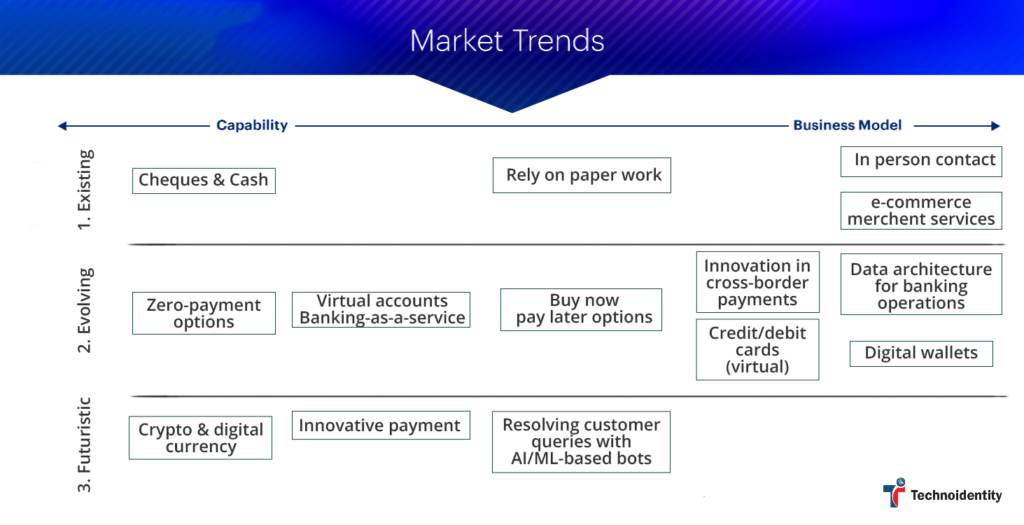

The relevant payments disruption scenario can be classified into three waves- ‘existing’, ‘evolving’, and ‘future’. However, these waves are dependent on each other. If there is no increase in customer acquisition through innovation to meet customer needs, payment providers will not be able to test the new set of use cases that are needed for the next cycle of growth.

Existing payment phase:

In coming years, digital payments are expected to grow driven by greater embedded modes. Customers will always look out for seamless end-to-end transactions than individual processes. On the other hand, merchants want to understand the best payment terms to offer, deliver seamless checkout, and payment requests, and offer pay-later options in one place.

At the consumer’s end, many super payment apps came into existence that combined payments, savings windows, bill payments, crypto offerings, shopping, and more. Every banking payment becomes successful when the focus is on delivering the best customer experience as they unfold new opportunities for open banking.

There are payment providers who are adapting to regulations like ISO 20022, which is an upcoming global standard for payments. It is interpreted that some 90% of global transactions are estimated to utilize ISO 20022 by 2023.

This adoption of the standards can prove to be advantageous for the financial system by enhancing the information carried in payment messages, advancing technology platforms compatibility, and giving opportunities relating to partnerships and innovation.

Evolving payment phase:

Many trends have been optimized and digital wallets have been widely used in the e-commerce market which was growing at the rate of 6% year-over-year between 2020-2025. 5. Because of service charges in banks due to mediators’ involvement, there’s a need that payment companies must re-assess their go-to-market propositions and existing technology silos. The shift towards digital transformation or purely cashless relies on how banks are focusing to address legacy costs, back-office operational budgets, low efficiency, and outdated infrastructure.

A major shift towards adapting new-gen technologies at every stage delivers innovation, brings greater customer experience, automates most manual activities and processes, accelerates go-to-market strategy, and supports niche product development.

Also, B2B offerings have also been scaling and smaller payment providers are moving inefficiently because of lacking expertise in building or developing new infrastructure therefore, seeking as-a-service offerings. The payment providers who have modernized their payment architectures can gain new income streams as they become competent enough to perform at maximum potential.

With all this happening, banks need to re-evaluate their market propositions. As organizations go through this change, checking legacy cost bases will come into picture.

Future payment phase:

The payments will become more embedded in the marketplaces and industries to break the barriers among banks and fintech players in near future. The online banking operations will keep on emerging as the next frontier. The probability of smart devices through which cashless transactions can be made are rapidly increasing. This is why most central banks are partnering with major tech companies and payment pioneers to remain uncompromised on sovereignty.

The revenue modes of 2024

Revenue pools differ greatly by area, based on current payment infrastructures and consumer choices. It is estimated that the major revenue pools will be those that have created use cases and clear markets. The revenue pools aren’t mutually exclusive, and the mixture of distinct value levers may multiply the approximate figures in reality.

In the future, payments will get more deeply embedded in greater financial propositions and consumer journeys. The ones that offer solutions for these end-to-end integrated payment systems will be the winners.

Considerations for payment providers

The payment providers have five opportunities for growing their potential:

- Identifying financial use cases that enables win-win scenario. Understanding customer needs and embedding payments ecosystem rather than keeping it separately from financial propositions.

- Defining core capabilities and go-to-market strategies clearly would make payment providers to consider your platform as a service or a wider ecosystem to scale operations effectively.

- Engaging the ecosystem – from API-led fintech to collaborating with partners across the value chain that deliver seamless user experience.

- Performing end-to-end technology assessment and automation to leverage microservices and cloud-enabled architecture to achieve agility and speed.

- Using automation and operating model – including decommissioning of legal platforms and zero-payment operations, fund new investments.

As a shift towards increasing efficiency and achieving greater core banking potential, it’s essential for banks to consider these metrics and step up to meet customer needs with seamless user experience.