With the payments industry, banks are evolving by switching to a faster payment ecosystem. One such kind of evolution by the Federal Reserve Bank is FedNow. FedNow will enable the potential for various businesses to carry out transactions. The new platform is yet to be launched and here is a light on it based on our research and understanding.

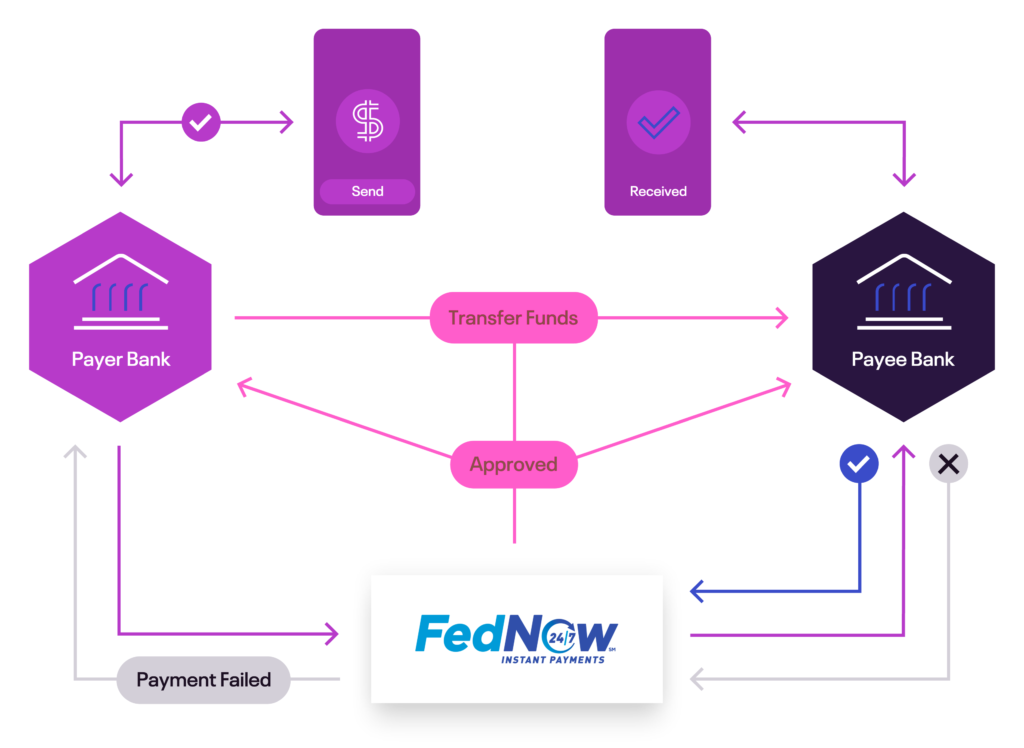

FedNow is a streamlined, cloud-based, and digitized instant payments service that’s been rolled out by the Federal Reserve Bank (Fed). FedNow service is in the activation to provide uninterrupted processing 24/7/365. It features integrated clearing functionality that helps financial institutions to deliver end-to-end payment services seamlessly to their customers.

As funds transfer between user accounts happens from time to time, there came the need for instant payments that enable immediate fund availability to the beneficiary. As a matter of fact, timings may vary from one transaction to another, but payments take place in seconds. For these reasons, real-time payments came into existence where they provide benefits such as irrevocability, rich data generation, & all-time availability.

Features of FedNow

The advantage of FedNow is that payment processing is done even during non-working/holiday restrictions. However, the transactions that happen through FedNow are limited to the maximum value. In addition to the 24/7/365 availability and integrated clearing functionality, the features come optional based on the type of participation by financial institutions.

- Send & Receive: Send, receive, and return customer payments and credit transfers from other financial institutions that support instant liquidity needs, send customer-initiated Request for Payment (RfPs), and choose to receive RfPs on behalf of customers.

- Receive only: Receive payments from financial institutions to meet liquidity needs, return the received payments, and send-but not receive – RfPs.

- Liquidity management transfers: It will enable the ability to complete high-amount-limit credit transfers with other financial institutions at scheduled intervals.

- Pricing: Competitive pricing versus wire transfers/debit card transactions where it encourages quick widespread adoption.

- Seamless experience: Instant payments provide a seamless user experience with no lags across all bank segments and industry verticals.

- Extended support: Banks need support for complex use cases to complete transactions that most existing payments fail. FedNow enables banks to scale the payments ecosystem while making the process simple and steadfast.

Benefits for organizations with the adoption of instant payments platform:

The FedNow features advanced technological aspects and revolutionizes the entire payments industry. With these features integrated, the institutions having FedNow will have the following benefits:

- The technology of instant payments can be accessed by a global audience – from small community banks to large financial institutions, thereby increasing equitable access for all organizations and individuals.

- For banks and non-banking companies, there is a rise in payment processing costs every year and the use of FedNow will eliminate these costs.

- The traditional method of paychecks will be eliminated. Instant access to paychecks and fund transfers improves cashflow management.

- FedNow will optimize liquidity management and cashflow forecasting for businesses to manage operational expenses and positive vendor relationships.

- Banks can send and receive rich data for conforming to the new ISO20022.

- Fraudulent transfers are easily identified as instant payment services that promote security through the development of industry-wide standards.

FedNow also comes with fraud prevention tools, payments inquiry support, and a liquidity management tool (available to FedNow participants and traditional liquidity providers as well as participants in private sector instant payment services that use a joint account at Reserve bank).

In the current scenario, instant payments are growing rapidly with a projected annual growth rate of 23.6% from 2020-2025. And central banks in more than 50 countries have instant payment networks that support immediate fund settlements. As a goal, Fed will optimize FedNow to provide safe and efficient instant payments to customers across financial institutions of all sizes.