Company & Client Information

TechnoIdentity

Founded a decade ago, we’ve grown from a small team into a leading global software consultancy. With our roots in custom systems delivered through agile methodology, we are leading and defining technologies. Organic growth is what we continue to believe in. We have developed an integrated approach to solve challenges by building on our engineering and strategy capabilities. People are at the heart of the organization and drive collaboration to deliver results fast.

Our purpose

“A world closer to social justice, especially in the direction of greater education and health care for all through technology innovation.”

Our reason for origin

“To advance technology through continuous learning and empathy so that organizations globally can deliver greater value and build a better future for humanity.”

Client Partner - Deposit Solutions

Founded in 2011 by Dr. Tim Sievers, Deposit Solutions is a globally recognized FinTech company headquartered in Hamburg, Germany. They have a long track record of successfully working with banks and have already mediated more than 20 billion Euros in deposits. Deposit Solutions is backed by renowned European and US investors. Deposit Solutions employs a team of more than 300 highly qualified and motivated staff. The executive team combines first-in-class finance and technology experience.

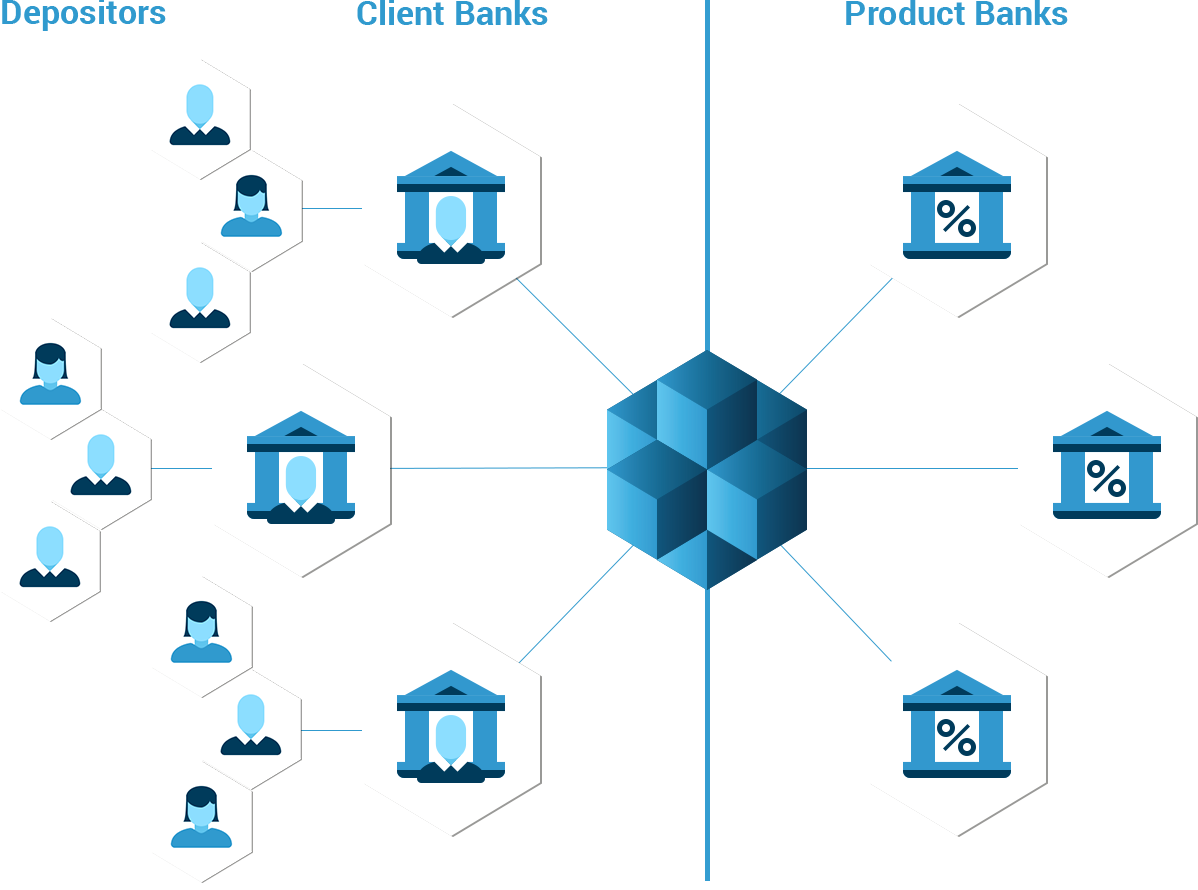

Deposit Solutions has developed a proprietary technology revolutionizing the value chain for banks and depositors. Their ground-breaking Open Banking platform allows banks to offer attractive third-party deposit products to their own customers through their existing accounts. As a result, banks looking for funding can gather deposits from new markets and client groups without having to set up and operate their own retail infrastructure, and depositors can access best-in-class deposit offers without having to open a new account at another bank.

Solution

- The Open Banking platform is a flexible tool to enable banks to connect with each other and become open.

- Our platform is the “middleware” in the new financial economy. In short, it provides a simple way for banks to implement Open Banking into their existing systems.

- The Open Banking platform creates a win-win-win situation for Client Banks, Product Banks and depositors.

- It supports a healthier banking system by providing an open market for deposit products, more effectively allocating resources and increasing customer benefits.