A massive change has been observed in the payments industry because of increased competition, regulatory interventions, technological innovations, cost pressures, and changing consumer preferences. Due to these factors, many banks had to revisit their operating models and take into consideration innovative payment modes and card solutions to differentiate and have a leading, competitive edge. To support this innovation, the payments ecosystem is much-needed transformation.

Organizations must transform their core operations and change business strategies to work closely in meeting the various needs of the customers. The extensive partnerships and collaborative models could steer the banks to implement end-to-end digital transformation that could bring value to their frontline services.

However, the payment processing cycle is not simple as it seems. As the transactions are becoming complex, it’s essential to redesign the entire payments ecosystem for the banking sector. The possible innovation through next-gen technologies could bring a huge transformation to make payments easily adaptable in the coming years.

The Challenges with existing payments ecosystem:

The redesign of the payments ecosystem is associated with a few challenges because of changing customer needs, dependency on old technology-supportive systems, and lack of expertise to develop these systems.

Changing customer preferences: Due to the changing customer needs and expectations in banking, there are gaps in payments that are only identified gap analysis is performed. Data and AI provide actionable insights to create engaging experiences through personalized approaches.

Old technology and infrastructure: The support for new solutions or next-gen technology could be a backdrop for banking sectors to go for next-level transformation. These create inefficiencies and gaps to fall off from the marketplace.

As part of the fintech transformation, the aim is to create lasting vision and innovation by replacing them with new systems that would support these technological frameworks.

Redesigning the processes: The redesign of processes in payments involves complex architectures to deploy and support of various APIs for frontend and backend operations.

Lack of expertise: The payments ecosystem needs a team who can deliver tangible results whenever the payments are happening throughout the online platforms. So, for this, an expert team scaling is really crucial right from planning through implementation to continuous monitoring.

As payments happen in real-time, delays and server breakdowns might happen. So, ensuring smooth payment processing and designing the ecosystem accordingly is a primary and most essential requirement of any banking organization.

Accelerating banking operations:

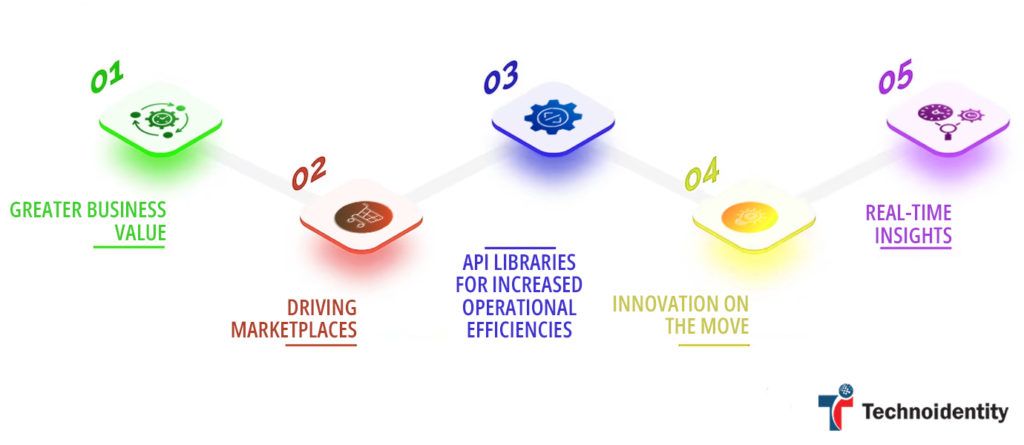

In today’s world, many organizations are developing a subset of real-time payment ecosystems that could bring much value to the existing baking scenarios. These include:

Greater business value:

The deep exploration in payments business and technology enables the large banks to strategize frameworks through challenges and enables them to gain a win-win situation.

Driving marketplaces:

The technology-led payment innovation helps the banking sector to create a typical business value chain that advances to bring greater value to the community services.

API libraries for increased operational efficiency:

The payments ecosystem will have a set of API libraries where they can address challenges in value chain visualization and enrichment, process and cost inefficiencies.

Curated user experiences:

The global banking sectors will have highly personalized payment capabilities where user experience is much valued.

Innovation on the move:

The banking industries can build products that could disrupt future markets. The scope for innovation can be truly game-changing when a real-time payments ecosystem is developed. The banks will have high scalable factors while innovating products or existing applications.

Real-time insights:

What’s the best way to engage the customers? It’s by providing personalized and real-time insights for them. This innovation of the payments ecosystem brings effective marketing in place and helps banks to make smart decisions in less time. The banks can perform big data-driven predictive analytics.

As a next step towards digital transformation, banks need to scale effectively by embedding new technology frontiers in order to cope with customer needs and the global marketplace.